SWIFT Messaging Types for Bank Guarantees and Their Uses

In the context of international banking, the SWIFT messaging system plays a key role in transmitting bank guarantees and related instruments securely between financial institutions. Several specific message types are used for this purpose, each designed to handle a particular aspect of the guarantee lifecycle.

Overview of Common SWIFT Guarantee Messages

MT 760 – Issuance of a Bank Guarantee or Standby Letter of Credit

The MT 760 is used when a financial institution issues a demand guarantee or standby letter of credit on behalf of a client. This message is typically sent from the issuing bank to the beneficiary’s bank, and it includes the terms, amount, applicable rules, and obligations of the guarantee.

💡 Use Case: An MT 760 is most commonly used in high-value transactions such as construction contracts, performance guarantees, payment assurances, or to cover financial obligations in cross-border deals.

MT 767 – Amendment to an Existing Guarantee

The MT 767 is used when an existing bank guarantee or standby letter of credit needs to be amended. This can include changes to the guarantee amount, extension of validity dates, changes in beneficiary, or any other modification to the original terms.

💡 Use Case: Common in projects where performance timelines change, or contractual obligations are adjusted over time.

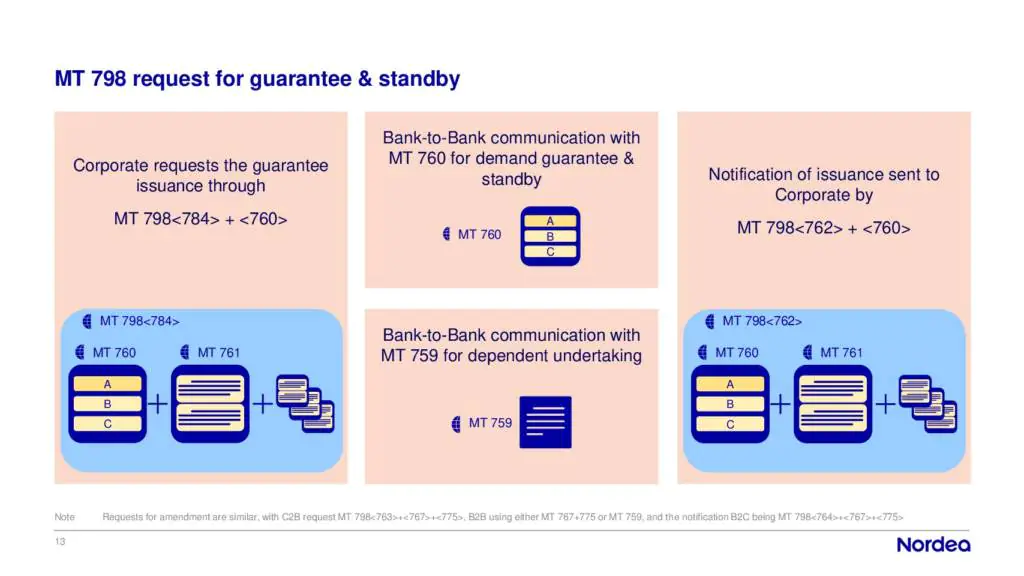

MT 798 – Corporate-to-Bank Trade Finance Messaging

The MT 798 is a flexible envelope message type used for corporate-to-bank communication under the SWIFT for Corporates framework. Within the 798 structure, corporates can exchange messages like MT 760 or other trade-related messages with their financial institutions in a standardized, secure format.

💡 Use Case: Used by corporates managing guarantees, LCs, or collections through integrated treasury or ERP systems, allowing end-to-end digital handling of trade finance instruments.

Field Structure and Messaging Format

Professionals familiar with the SWIFT format for bank guarantees will recognize that the core content of a guarantee is primarily communicated through Field 77C: Details of Guarantee. Regardless of the specifics—such as who bears the cost, what legal jurisdiction applies, or which rules govern the instrument—the critical terms are included in this free-format narrative field.

This approach, while offering flexibility, also requires precision and consistency in drafting. The entire legal language of the guarantee must be accurately inserted into this single field, making attention to detail absolutely essential.

Key Considerations When Using MT Messages for Guarantees

-

Clarity of Terms: Since most terms are embedded in a free-text field (77C), any ambiguity may lead to disputes or rejection of the instrument.

-

Applicable Rules and Law: While fields exist to indicate the rules (e.g., URDG 758, ISP98), the actual enforceability depends on how clearly these are referenced and applied within the message.

-

Amendments Require Precision: Changes via MT 767 must align precisely with the original MT 760 and be accepted by all involved parties.

-

Digital Integration: The use of MT 798 allows corporates to streamline communication with their banks and automate compliance with internal processes.

SWIFT Guarantee Messaging: MT 760, MT 767, MT 798, and the Transition to Structured Formats

SWIFT messaging plays a central role in the secure transmission of bank guarantees and standby letters of credit between banks and corporate clients. While traditionally dominated by flexible narrative-based formats, new developments are introducing structured fields to support automation and clarity.

Flexibility vs. Automation in Free-Format Messaging

Bank guarantee messages such as MT 760 (issuance) and MT 767 (amendment) offer wide flexibility through their use of free-format fields—especially Field 77C: Details of Guarantee. This structure allows banks to transmit virtually any type of guarantee content, whether it’s a simple request to advise a guarantee, confirm a standby, or issue a local undertaking backed by a chain of counter-guarantees.

💡 Free-format messaging enables almost any use case—but with significant limitations in automation.

However, this flexibility comes at a cost. Because key data (such as the parties involved, guarantee amount, and expiration date) is buried within an unstructured text block, banks cannot easily extract this data for processing. Automated compliance screening, transaction routing, and data indexing all become difficult without manual intervention.

Structured Messaging Through MT 798

The MT 798 message, used in the corporate-to-bank channel, partially solves this problem by incorporating a structured index alongside the narrative field. This allows for improved processing while retaining the flexibility of free-text guarantee content.

Still, the unstructured narrative field remains, and true automation is limited unless the information is replicated in both places consistently.

Upcoming Changes to SWIFT Standards (Effective November 2021)

Structured Fields in MT 760 and MT 767

The updated SWIFT standards—scheduled to go live in November 2021—introduce structured data fields to the traditional bank-to-bank MT 760 and MT 767 formats. Key elements such as:

-

Guarantee Amount

-

Expiry Date

-

Involved Parties

...will now have dedicated fields, reducing reliance on free-text formatting.

💡 These changes aim to reduce ambiguity and enable greater automation across the trade finance ecosystem.

Key Restrictions and Changes

-

MT 760 / 767 Scope Restricted: Going forward, these messages are to be used only for demand guarantees and standby letters of credit.

-

Dependent Undertakings (Sureties, Accessory Guarantees) must now be sent via MT 759, which continues to use a single narrative field.

-

New message types are also being introduced to cover payment demands and amendment responses.

Challenges with Dependent Undertakings and MT 759

While the structured updates to MT 760 and 767 are a step forward, the segregation of dependent undertakings into the free-format MT 759 presents operational difficulties:

-

Increased Processing Complexity

Since MT 759 lacks structured fields, banks must manually parse information from the narrative, raising the risk of data mismatch or processing errors. -

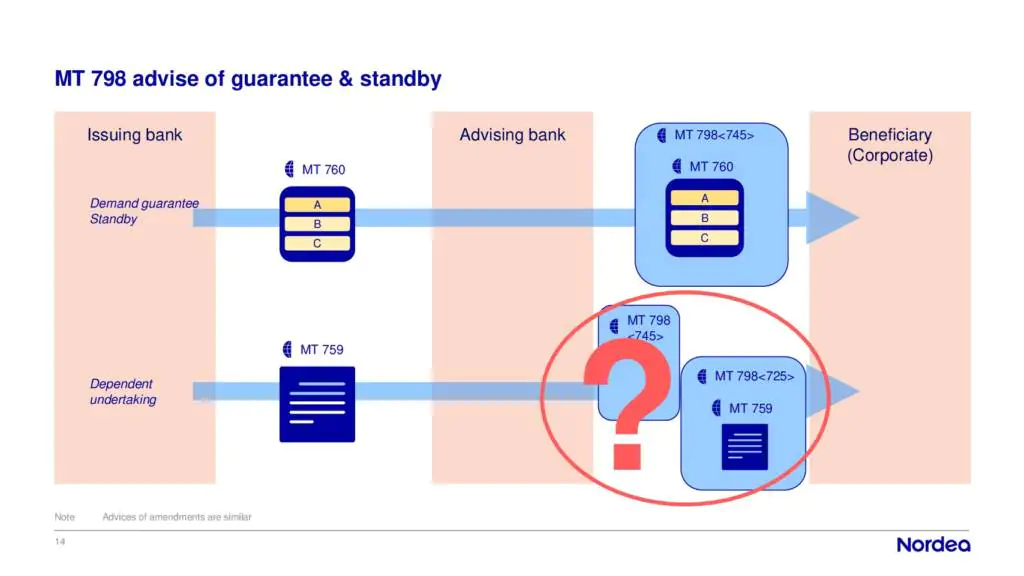

Incompatibility with MT 798 Standards

Corporate-to-bank MT 798 messages already support structured data. However, when a dependent undertaking is issued as MT 759, the bank must:-

Construct the request using MT 760-style structure (despite using MT 759 for issuance)

-

Translate the outgoing MT 759 back into MT 760 format to share with the corporate (despite MT 760 disallowing dependent undertakings in bank-to-bank use)

-

-

Misalignment in Communication Flows

This workflow contradicts the intent of the structured formats. If the DEPU code (Dependent Undertaking) were permitted in MT 760/767, the need for these workarounds would be eliminated.

Impact on Corporates

For corporates using MT 798, the transition is mostly seamless for demand guarantees and standbys, since structured fields are already part of their workflows.

However, dependent undertakings remain problematic:

-

Corporates must format their request like an MT 760

-

The bank must issue the guarantee using MT 759

-

The bank must then convert the MT 759 back into a simulated MT 760 for communication back to the corporate

⚠️ This disconnect increases operational risk and may lead to inconsistencies between what the corporate expects and what is issued.

Advising Bank Dilemmas

Advising banks face similar issues when asked to forward surety texts or accessory guarantees:

-

If they forward the MT 759 as-is, the corporate may be dissatisfied due to lack of structured data.

-

If they convert the MT 759 to MT 760, the structured format violates the current messaging rule that disallows sureties in MT 760—again risking data inconsistency.

🛑 The core issue is that dependent undertakings are structurally incompatible with the MT 760/767 framework under current rules.

Looking Ahead: A Case for Realignment

SWIFT's Structured Formats: A Digital Trade Opportunity

The move toward structured formats is promising and enables significant progress in automation, compliance screening, and digital transformation. But the current separation between MT 759 and MT 760 introduces friction that contradicts real-world practices.

✅ Market alignment would be improved by allowing dependent undertakings (DEPU) within MT 760/767

✅ This would simplify processing and better align bank-to-bank and corporate-to-bank communications

Conclusion

The transition to structured SWIFT messages for guarantees represents a major evolution in trade finance. While the new formats bring clear advantages in automation and process control, their success will depend on:

-

Harmonizing message standards across parties

-

Allowing exceptions like DEPU where practical

-

Involving corporates and software providers in shaping ongoing standardization

As implementation unfolds, ongoing collaboration will be essential to ensure that messaging reforms support—not hinder—the practical needs of trade finance professionals worldwide.